When researching stocks or stock funds, you’ll often see companies categorized by Market Capitalization (Market Cap) depending on various marketplace standards. Understanding what a business is worth is an important task and often difficult to quickly and accurately ascertain. Market capitalization is a quick and easy method for estimating a company’s value.

Specifically by extrapolating what the market thinks it is worth for publicly traded companies. In such a case, multiply the share price by the number of available shares. After a company goes public and starts trading on the exchange, its price is often based on supply and demand for its market shares. What if there is a high demand for shares due to favorable factors?

Well, the price would increase. If the company’s future growth potential doesn’t look good, sellers of the stock could drive down its price. The market cap then becomes a real-time estimate of the company’s value. On the one hand, a particular company’s share price may be $50. On the other hand, another company’s share price may be $100 or even more than that.

In such a case, this does not mean the second company is twice as large as the first. When analyzing securities, remember to factor in the number of shares issued (thereby exploring the company’s total market cap). So, what is Market Capitalization, and why does it matter in business operations? Well, stay with us till the end so that you can learn a few basic things.

Getting To Know What Market Capitalization Entails For New Investors

To enumerate, Market Capitalization, or Market Cap, is a company’s size measurement. It’s the total value of a company’s outstanding stock shares, including publicly traded and restricted shares held by company officers and insiders. It’s the value of the total outstanding shares; it’s computed by multiplying the total number of shares issued by the company by the stock price.

Although it is often used to describe a company, the market capitalization strategy does not measure the equity value of a business. Otherwise, only a thorough analysis of a company’s fundamentals can do that. It is inadequate to value a company because the market price on which it is based does not necessarily reflect how much a piece of the business is worth.

It must be remembered that shares are often overvalued — or undervalued by the market — meaning the market price determines only how much it is willing to pay for its shares. Although it measures the cost of buying all of a company’s shares, the market cap does not determine the amount the company would cost to acquire in a merger transaction.

A high market cap signifies that the company has a more significant presence in the market. Larger companies may have less growth potential than start-up firms. Still, larger companies may be able to secure financing for cheaper, have a more consistent stream of revenue, and capitalize on brand recognition. So, how is Market Capitalization calculated?

How Market Capitalization Is Calculated To Measure Business Value

In simple terms, market capitalization refers to the market value of a company’s equity. It is a simple but essential measure calculated by multiplying a company’s outstanding shares by its price per share. For example, a company priced at $20 per share with 100 million shares outstanding would have a Market Capitalization of $2 billion as per net-worth calculations.

Market Capitalization demonstrates the size and the power of a company. It is an essential tool for analytics, especially when comparing companies. Market cap is often used as a baseline for analysis, as all other financial metrics must be viewed through this lens. For example, a company could have had twice as much revenue as any other company in the industry.

However, if the company’s market cap is four times as significant, it could be underperforming. A better method of calculating the price of acquiring a business outright is the enterprise value to determine the actual worth. To calculate Market Cap, you take the total number of a company’s shares outstanding and multiply that figure by the company’s current stock price.

For example, let’s say a company has 5 million shares outstanding. And that its current stock price is $20, it has a Market Capitalization of $100 million. You may hear companies described as large-cap, mid-cap, small-cap, or even mega-cap or micro-cap. The delineation between each group can vary. But generally, you’ll see them broken down in a particular order.

They are usually broken down like this:

- mega-cap: market value of $200 billion or more;

- large-cap: market value between $10 billion and $200 billion;

- mid-cap: market value between $2 billion and $10 billion;

- small-cap: market value between $250 million and $2 billion; and

- micro-cap: market value of less than $250 million.

Certain stock indexes or investment funds will use this measure to group companies by size. For example, the S&P 500 comprises mega-cap and large-cap stocks. It is weighed by market cap, so companies with a higher market cap account for relatively more of the index than companies with a smaller cap. Meanwhile, the Russell 2000 Index is a small-cap market.

The formula for market capitalization is as follows:

Market Cap = Current Share Price * Total Number of Shares Outstanding

For example, a company with 20 million shares selling at $100 a share would have a market cap of $2 billion. On the other hand, a second company with a share price of $1,000 but only 10,000 shares outstanding would only have a market cap of $10 million. As a rule of thumb, an Initial Public Offering (IPO) establishes a company’s market capitalization.

Before an IPO, the company that wishes to go public enlists an investment bank to employ valuation techniques to derive a company’s value and to determine how many shares will be offered to the public and at what price. For instance, a company whose IPO value is $100 million by its investment bank may issue 10 million shares at $10 per share.

Or rather, they may equivalently want to issue 20 million at $5 a share. In either instance, the initial market cap would be $100 million. Newer investors might mistakenly believe that stock price alone could be a good indicator of how large a company is. Still, the number of outstanding shares’s the most important in determining a company’s size.

Why Market Capitalization Matters In Finacial Business Trading

For starters, a market cap can give you a general idea of where a company stands in business development. Is it a relatively new public company, for example? If so, it might have room for growth. After all, access to investor capital to expand the business is why many companies go public in the first place. It can also provide a rough gauge of a company’s stability.

Large-cap companies tend to be less vulnerable to the ups and downs of the market than mid-cap companies, and mid-cap companies are generally less susceptible to volatility than small-cap companies. That’s partly because larger companies typically have more significant financial reserves and often can absorb losses easily and bounce back more quickly.

Especially from a bad year. At the same time, smaller companies might have tremendous potential for faster growth in economic boom times than larger ones. This is why some dividend seekers will use the market cap as a filter when looking for companies that pay consistent dividends. These generalizations are no guarantee that any particular entity wins.

There is no guarantee that a large-cap company will weather a downturn well or that any specific small-cap company will or won’t thrive. Still, the market cap can be a helpful gauge — particularly when diversifying your portfolio for business. When you diversify, you aim to manage risk by spreading your investments. You can diversify by investing in different asset classes.

The Topmost Best And The Right Marketplace Investment Strategy

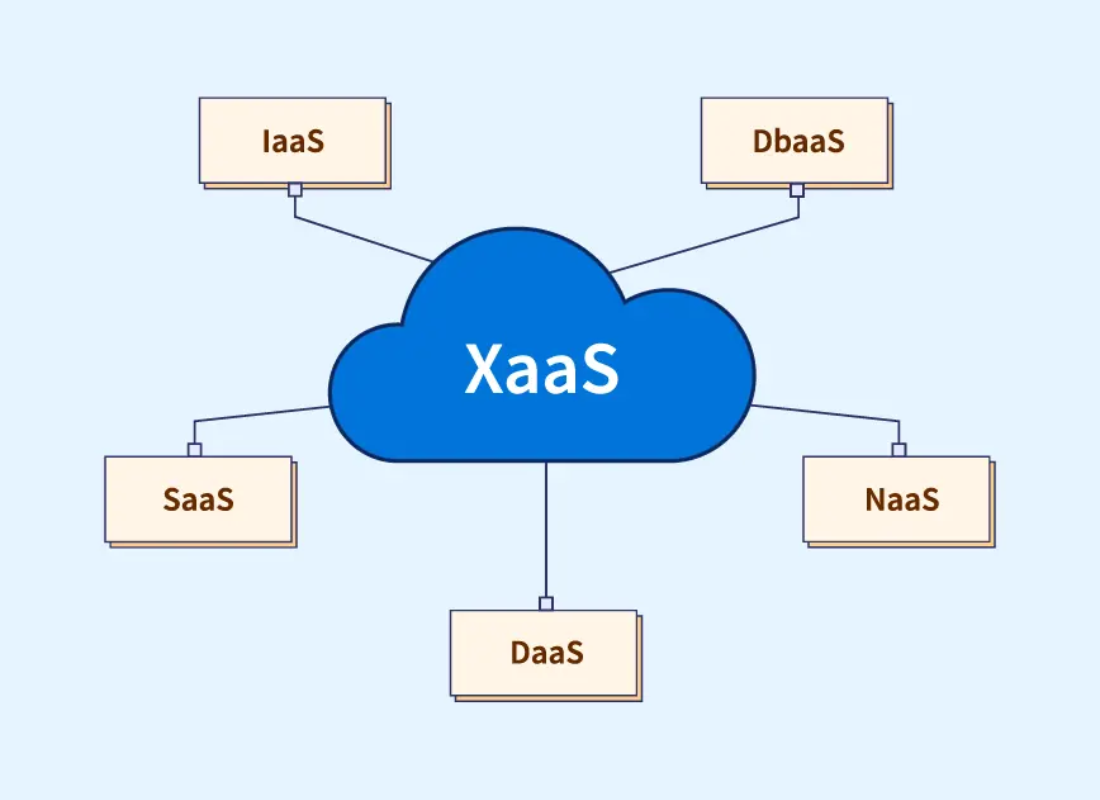

Given its simplicity and effectiveness for risk assessment, market capitalization can be a helpful metric in determining which stocks you are interested in and how to diversify your portfolio with companies of different sizes. You can diversify by investing among other asset classes, for example, in the stock market, NFT, and bonds. And you can also diversify within asset classes.

Investing in small-cap and large-cap stocks is one example of diversifying within one asset class (stocks). A high market cap signifies that the company has a more prominent presence in the market. Larger companies may have less growth potential compared to start-up firms, but they may be able to secure financing for cheaper and have a more consistent stream.

Particularly in terms of revenue and capitalizing on brand recognition. Though applicable to every company, companies with higher market caps are generally less risky than companies with lower market caps. For your information, market cap does not affect stock price; instead, market cap is calculated by analyzing the stock price and number of shares issued.

Although a blue-chip stock may perform better because of organizational efficiency and a more fabulous market presence, in that case, having a higher market cap does not directly impact stock prices. Let’s elaborate on these market caps.

1. Large-Market Cap:

Large-Cap (aka big-cap) companies typically have a market capitalization of $10 billion or more. These companies have usually been around long and are major players in well-established industries. Investing in large-cap companies does not necessarily bring in huge returns in a short period. Still, over the long run, these companies generally reward investors with a consistent increase in share value and dividend payments. Examples of large-cap companies — and remember that this is an ever-changing sample — are Apple Inc., Microsoft Corp., Google parent Alphabet Inc., Facebook Meta, etc.

2. Mid-Market Cap:

Mid-Cap companies generally have a market capitalization of between $2 billion and $10 billion. Such established companies operate in an industry expected to experience rapid growth. It’s worth mentioning that some of these mid-cap companies are in the process of expanding. They carry an inherently higher risk than large-cap companies because they are not as established but attractive for their growth potential. One great example is Eagle Materials Inc. and the like.

3. Small-Market Cap:

Small-Cap companies have a market cap of between $300 million to $2 billion. These small companies could be younger and serve niche markets and new industries. But they are considered higher-risk investments due to their age, the needs they meet, and their size.4 Smaller companies with fewer resources are more sensitive to economic slowdowns.

4. Micro-Market Cap:

Micro-Cap is for smaller companies with values between approximately $50 million and $300 million. As a result, small-cap and micro-cap share prices tend to be more volatile and less liquid than more mature and larger companies. At the same time, small companies often provide more significant growth opportunities than large caps.

To give you an idea, take Company A and Company B, for example. Both have stocks trading at $50 a share. But, on one side, Company A has 5 million shares outstanding. While on the other side, Company B has 5 billion shares outstanding.

That means Company A has a market capitalization of $250 million, making it a small-cap company. In contrast, Company B has a market capitalization of $250 billion, meaning it’s a vast, large-cap company — often called a mega-cap company.

Understanding What A Diluted Market Capitalization Often Entails

It’s important to realize that two main factors may alter a company’s market cap: significant stock price changes or when a company issues or repurchases shares. Through a process known as dilution, an investor who exercises many warrants can also increase the number of shares on the market and negatively affect shareholders.

A security’s market capitalization may change due to outstanding shares. This is especially prevalent in Cryptocurrency, where new tokens or coins are issued or minted frequently. Still, a different market cap formula can calculate the potential market cap because new offerings are theoretically thin the value of existing currencies, tokens, or shares.

In particular, this happens when all authorized shares or asset tokens are issued and still worth the current trading price. This concept is known as diluted market capitalization; the calculation method is also relatively straightforward.

The specific formula is as follows:

Diluted Market Cap = Current Share Price * Total Number of Shares Authorized

For example, consider Bitcoin trading at roughly $24,000 per coin as of mid-August 2022. At the time of writing, approximately 19.1 million Bitcoin (BTC) were also issued. However, the total number of potential Bitcoin that may be minted is 21 million.

The above calculations are as follows:

Market Cap = $24,000 * 19.1 million = $458.4 billion

Diluted Market Cap = $24,000 * 21 million = $504 billion

Though applicable to every company, companies with higher market caps are generally less risky than companies with lower market caps. Analysts use the diluted market cap to understand better potential changes to security, token, or coin price. For example, imagine if all 21 million Bitcoin were minted tomorrow. What if it retained the same market cap of $458.4 billion?

The price would drop to roughly $21,828 ($458.4 billion / 21 million). Companies with extensive inventories of unissued securities or coins are at greater risk of price decreases if investors wish to keep their market cap unchanged regardless of outstanding tokens. However, some investors prefer to refer to a free-float market capitalization over just other market caps.

The Market Cap Limitations That Businesses Should Know About

It’s important to remember that market cap is the perceived value of a company because investors determine stock price. It isn’t necessarily the actual value of a company and its parts. Some of that perceived value may stem from future growth or product introduction expectations. Still, those expectations may not pan out, in which case the company’s share price.

And thus, its market cap — is likely to adjust accordingly. That’s why looking at several metrics when considering an investment is a good idea. Eventually, a market cap can be one tool you use to develop a diverse portfolio, but it shouldn’t be your only tool. One could argue that analysts track market cap to determine which companies may be undervalued or overvalued.

In this lens, a market cap can lead an investor to buy or sell shares based on the company’s relative value compared to the industry or competitors. Still, the stock price of a claim is determined as the fair value per the market, not by a company’s market capitalization. Market cap demonstrates the size of a company as a crucial tool for analytics to compare value.

Market Capitalization does not affect stock price in any way. Instead, market capitalization is calculated by analyzing the stock price and number of shares issued. Although a blue-chip stock may perform better because of organizational efficiency and a more fabulous market presence, it’s clear that a higher market capitalization does not directly impact stock prices.

Summary Thoughts:

The bottom line is that market cap is often used as a baseline for analysis, as all other financial metrics must be viewed through this lens. For example, a company could have had twice as much revenue as any other company in the industry. However, if the company’s market cap is four times as significant, the argument could be made that company is underperforming.

Similarly, a market cap can be valuable for investors watching stocks and evaluating potential investments. Market Capitalization is a quick and easy method for estimating a company’s value by extrapolating what the market thinks it is worth for publicly traded companies. Most investors use this figure to determine a company’s size instead of sales or total assets.

Related Resource: How To Mine Bitcoins For Free | Tools To Use & Trade With

In an acquisition, the market cap determines whether a takeover candidate represents excellent value to the acquirer. There are advantages and drawbacks to having a large market capitalization. On the one hand, larger companies might secure better financing terms from banks by selling corporate bonds. Also, these companies might benefit from competitive advantages.

More so, garnering benefits related to their sizes, such as economies of scale or widespread brand recognition. On the other hand, large companies might have limited opportunities for continued growth and may therefore see their growth rates decline over time. So, what is your take on this review article guide? Please share your opinions and thoughts in our comments.