Markedly, it’s worth mentioning that today’s topic is Know Your Business (KYB) and Ultimate Beneficial Ownership (UBO). We will also understand the need for and the importance of KYB – know your business and ultimate beneficial ownership. B2C companies follow various steps to verify their customers’ identities. This is known as the Know Your Customer (KYC) Process.

Other businesses and financial institutes must do the same verification process for businesses they onboard. This process is known as Know Your Business (KYB) or Business Risk Assessment. In the past few years, the need for KYB regulation has been changed by the Financial Action Task Force (FATF). KYC (Know-Your-Customers) is a basic idea of verifying identities per information data.

It also utilizes the process of verifying documentation and making sure they are real. It also verifies whether a specific person is on the prohibited list. Today’s financial and business world is highly regulated under the strict Know Your Business regulations that require companies to ensure transparency and fraud prevention. Nevertheless, it comes at the cost of extensive strategy.

An authentication processes that verify everything from businesses to the official individuals behind them. Authentication and verification of Ultimate Beneficial Owners is integral to KYB since company officials pose a particular risk to the partnered businesses. Learn how UBO verification helps companies in effective business screening and minimize the risk of financial fraud.

Understanding The Ultimate Beneficial Ownership (UBO) Verification Process

An Ultimate Beneficial Owner (UBO)) is an official business entity or an individual who safeguards the financial interests of companies. This individual is considered an official decision-maker to a significant extent and can be responsible for every business action. Therefore, it is now more essential than ever for businesses to ensure UBO Verification complies with all the policies.

Such as the standard Anti-Money Laundering (AML) and Know Your Business (KYB) regulations. Financial Action Task Force (FATF) describes UBOs as “The natural person who ultimately owns or controls a customer and the natural person on whose behalf a transaction is being conducted.” Today, the financial industry is highly regulated, ranking among the world’s strictly governed.

The same level of oversight is applied to the financial dealings of multinational firms. Several pieces of anti-money-laundering legislation have been passed in recent years, increasing the difficulty of maintaining regulatory compliance in the financial sector. Authorities in many countries have been brainstorming new strategies to combat the global expansion of money laundering.

As defined by the Financial Action Task Force, “UBO is the natural person who ultimately owns or controls a customer and the natural person on whose behalf a transaction is being conducted.“. It also includes people with ultimate effective control over a legal entity or arrangement, as limited by FATF’s ultimate beneficial owner rules, standard regulations, and other policies.

Including:

- Individuals who hold at least 25% of the company’s shares;

- Individuals who account for at least 25% of the vote,

- Investors who receive at least 25% of a company’s profits,

- Authorized representatives,

- Guardian of minors,

- A company’s owners might be hidden from public view by appointing corporate or nominee directors.

After the Panama Papers Leak, government agencies learned that the absence of beneficial ownership transparency was a gap in the existing due diligence mechanism. Notwithstanding, lack of transparency over beneficial ownership was a significant issue that fostered criminals to launder money through offshore accounts. In 2016, regulators began pushing back with new laws.

The United Nations Office on Drugs and Crime states that more than $2 trillion is made illegally yearly. If a company’s UBOs are exposed, they may try to cancel their identities to avoid legal ramifications rather than admit to engaging in criminal activities. By remaining anonymous, criminals can engage in activities like tax evasion, money laundering, embezzlement, and corruption.

Why A Strategic UBO Verification Process Matters In Business Operations

Companies subject to standard KYB regulations should have complete certainty over the businesses and other parties they trade with. It requires companies to validate the actual identity of legal people to ensure regulatory compliance. Furthermore, extensive UBO verification after business onboarding helps control financial losses while safeguarding the company’s market reputation.

The United Nations Office on Drugs and Crime reports that businesses make more than $2 trillion every year. However, suppose a business’s Ultimate Beneficial Owner is exposed. In that case, they can try to nullify their identity to bypass legal consequences instead of admitting their engagement in criminal financial activities and heinous crimes like money laundering and tax evasion.

In addition, they also engage in corruption and yet stay anonymous. However, disclosure of ultimate beneficial owners significantly enhances the security and integrity of the financial system. It is essential to adhere to FinCEN requirements and determine who the genuine Ultimate Beneficial Owner is. Without UBO checks, an organization could be linked to money laundering.

They could also be associated with terrorist financing, like Singapore-based DBS Bank Limited. Eventually, most of these organizations were accused of not taking anti-money laundering measures sufficiently. The Singapore DBS Bank Limited firm was charged a $25,000,000 penalty for other alleged financial wrongdoings. Now, proper due diligence is crucial more than ever.

The UBO Benefits:

- Transparency and Compliance

- Empower Risk Mitigation

- AML and Due Diligence

- Prevent Illicit Activities

- Meet The Global Standards

- Foster Trust & Maintain Reputation

By all means, those subject to regulation must have complete confidence in the parties they deal with. Disclosure of beneficial owners enhances the financial system’s safety and openness. Validating the real identities of legal people is essential to regulatory compliance, whether clients or business partners. It also helps prevent monetary loss and safeguards the company’s reputation.

How To Ensure An Effective Business UBO Verification Process Outcomes

As mentioned, a corporation’s Ultimate Beneficial Owner is the person or entity with the company’s most significant direct or indirect financial interest. This person is the ultimate beneficiary of the company’s actions, even if they do not have hands-on management responsibilities—compliance with anti-money-laundering (AML) legislation and limiting the risk of financial crimes.

However, this depends on knowing who the Ultimate Beneficial Owner is. Beneficial ownership and legal ownership diverge in the realm of rights and control over assets. Legal ownership officially recognizes ownership, granting legal rights and obligations. In contrast, beneficial ownership encompasses the actual perks derived from an asset, such as profits and decision-making authority.

Notably, according to a FATF assessment in 2016, only two of the G20 had substantially effective beneficial ownership regulations. While the FATF is committed to ensuring effective Beneficial Ownership transparency regulations are in place, it acknowledges its difficulty. A solution may be found using technologies and methods that expedite and enhance the process’s precision.

Incorporating several databases and technologies into an automated system helps speed up and improve the accuracy of the identification procedure. This contrast holds weight in trading, anonymity, concealing assets, tax avoidance, influencing transparency, and accountability. Some of the reasons why beneficial and legal ownership are different are as follows:

Trading

For security and convenience reasons, many people who possess securities prefer to trade them under their broker’s name. This Ultimate Beneficial Ownership (UBO) practice is legitimate and frequent in the banking industry.

Anonymity

Some people conceal their true identity by registering their assets under someone else’s name for security and privacy reasons. Famous people, politicians, and others who don’t want their home address made public could re-title their property in someone else’s name. There is no law against this.

Concealing Assets

Some people have assets registered differently to avoid losing property after a divorce or lawsuit. Financial fraud, including using an Ultimate Beneficial Ownership (UBO), is prohibited.

Tax Avoidance

Some individuals and businesses prefer to split ownership of their assets among several names to reduce their taxable income. Using an Ultimate Beneficial Ownership (UBO) in this way is prohibited since it is used to avoid paying taxes.

Money Laundering

Money laundering hides the genuine ownership of assets and the origin of funds gained illegally. The Ultimate Beneficial Owner of illicitly acquired assets may be concealed, or their involvement with money laundering may be hidden by having those assets registered in another legal owner’s name. Terrorist groups might also benefit from money launderers. Both individuals who engage in money laundering and those who help it by failing to enforce internal anti-laundering policies face legal consequences.

How To Identify An Effective Ultimate Beneficial Ownership (UBO)

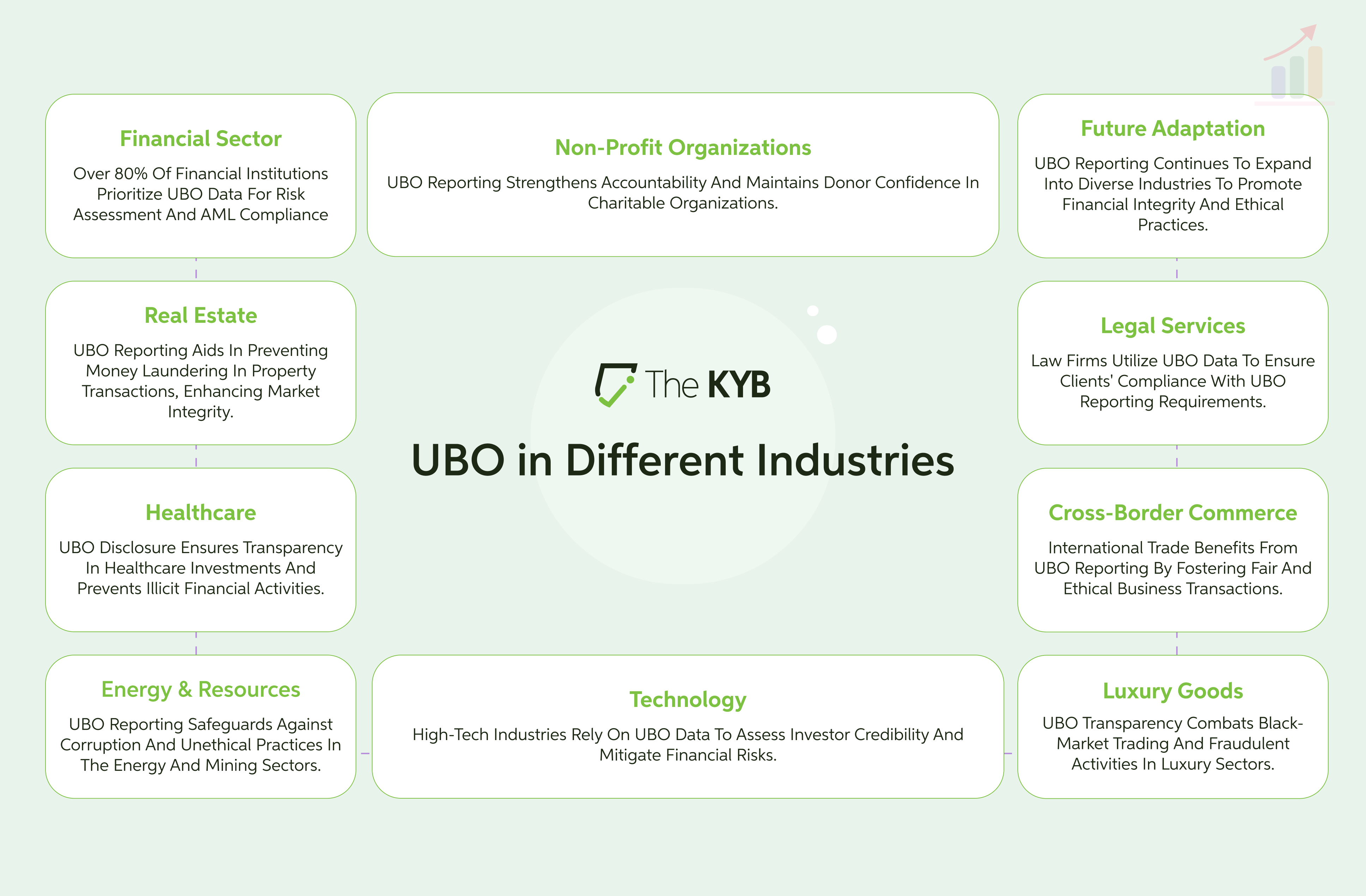

Identifying Ultimate Beneficial Owners is crucial in several sectors, including real estate, banking, and finance. With a better grasp of who gains from a transaction, financial crimes like money laundering can be avoided, and reputational harm can be avoided. Investigating potential partners or investors in these sectors is critical to verify they align with UBO rules and regulations.

As you can see from the image below, identifying UBOs is essential for maintaining openness, controlling risks, and meeting legal requirements. Businesses can lessen the likelihood of financial crimes, reputational damage, and monetary implications by learning who the Ultimate Beneficiary is. To guarantee an Ultimate Beneficial Ownership (UBO), laws and regulations verify the company.

Therefore, businesses must follow best practices, interact with regulators, and implement the required technological solutions. Financial institutions are broadly defined in the rule to encompass such entities as futures commission merchants, commodity brokers, and mutual funds. Companies, partnerships, and business trusts are all legal entities that can be customers.

Steps To Identify The UBO:

- Understanding the business structure: To start, learn about who owns and runs the company, directly and indirectly.

- Analyzing the supporting paperwork: For clues as to who the Ultimate Beneficial Ownership (UBO) is, look at shareholder agreements, trust deeds, and partnership contracts. These records may reveal essential facts regarding the company’s management and ownership.

- Performing due diligence: Investigate the business, its owners, and any associated parties to spot warning signs that could lead to further scrutiny.

- Tracing the ownership chain: Find out who controls the company by following the money trace. For this purpose, reviewing trust deeds, share registers, and other legal documents is necessary.

- UBO Authentication: Once the Ultimate Beneficial Ownership (UBO) has been located, their ownership stake and identification must be confirmed using external resources such as public documents and databases. It is critical to follow these procedures precisely to get the right Ultimate Beneficial Owner.

Next, the essential main phases listed below can significantly help organizations develop effective Ultimate Beneficial Ownership (UBO) verification schedules.

UBO Information Repositories

These databases collect information about UBOs from various sources, including business registrations and government documents. These databases are helpful since they make identifying the Ultimate Beneficial Owner easier and provide more details about them.

Gain Necessary Company Vitals

During UBO authentication, businesses must gather and verify all the company records effectively. Some primary business vitals include a company identification number, registered name and address, legal status of the business, and management personnel. However, based on region and regulatory standards, fraud prevention standards may vary from company to company.

Business Ownership Structure Analysis

This step of the Ultimate Beneficial Ownership (UBO) verification process involves determining who possesses an ownership stake in a company and whether an individual holds the status of direct ownership or via another party.

The Ultimate Beneficial Owner Identification

In this stage of the Ultimate Beneficial Ownership (UBO) verification process, companies have to calculate the entire ownership stake, including management control of an individual, and specify if it intersects the maximum criteria for UBO reporting.

Thorough Anti-Money Laundering/Know Your Business Checks

This stage works with the help of Anti-Money Laundering and Know Your Business (KYB) checks. It involves extensive AML/KYC procedures, such as UBO screening on everyone identified as an Ultimate Beneficial Ownership (UBO). Due diligence may be automated with KYC and AML systems, as can the identification and verification of UBOs. These solutions can also lessen the likelihood of financial crimes and help organizations comply with applicable legislation.

Enhanced Due Diligence (EDD)

In some instances, dealing with high-risk businesses or complicated ownership structures, it becomes imperative for companies to conduct further due diligence standards This includes performing more extensive analysis, employing third-party providers, and using technological means to accumulate more in-depth details about the Ultimate Beneficial Owners.

Ongoing Monitoring & Risk Assessment

KYB verification that involves UBO checks must be ongoing since there’s always a possibility that a business or customer profile changes as time passes. For instance, an Ultimate Beneficial Owner could be approved or involved in suspicious activities such as high-risk transactions or modify their private information.

Utilizing The KYB For Ultimate Beneficial Ownership (UBO) Verification

Verify and onboard businesses while identifying Ultimate Beneficial Owners (UBOs) within seconds. Explore our innovative KYB solutions and learn how we can help you simplify your business verification process. Get started and utilize The KYB for your Ultimate Beneficial Ownership (UBO) verification process.

Remember, ‘The KYB’ offers advanced UBO verification to identify actual beneficial owners in real-time. As a result, this ensures regulatory compliance. Expedite UBO verification, simplify ownership insights, and adhere effortlessly to regulations. Uncover ownership percentages, discern significant control, and trace direct/indirect ownership. Explore entity relationships.

Gain vital insights for ownership comprehension as you verify fund legitimacy and screen UBOs against global sanctions. At the same time, visualize ownership structure for informed decisions, streamline due diligence, meet AML compliance, and mitigate risks. Elevate business operations with The KYB’s comprehensive solution. Strengthen each stage of the business onboarding process.

According to the regulation, “beneficial owner” refers to those who own at least 25% of a company’s voting stock and have significant control over its management and daily operations. With the help of The KYB, you can implement Ultimate Beneficial Ownership (UBO) checks throughout the business onboarding process for premier fraud prevention and global compliance assurance.

Quick KYB Check

- Verify business registration details via official sources

- Collect officers and organizational structure details

- Identify beneficial owner details

- Access public business filings

Enhanced Due Diligence

- Request official documents (e.g., articles of association, certificate of incorporation)

- Verify licenses and permits

- Evaluate indirect ownership in complex structures

- Assess financial performance records

Compliance Screening

- AML for business

- Adverse media checks

- Regulatory enforcement

- KYC/AML checks on critical people

Risk Assessment

- Customizable risk-scoring rules for automated decisions

- Assess jurisdictional, financial performance, political, and economic risks

Perpetual KYB

- Track changes in business profile and activities

- Ensure continuous regulatory and agreement compliance

- Ongoing monitoring of company officers

They help integrate premier KYB & UBO data seamlessly into your infrastructure. Integrate your organization’s workflow with external data sources to streamline and accelerate decision-making.

Final Words:

An Ultimate Beneficial Ownership (UBO) Verification is a compulsory part of Know Your Business laws that strive to ensure transparency and prevent companies from challenges like financial fraud. Usually, identifying the ultimate beneficial owners of enterprises is vital when mitigating the risks associated with business operations, especially when dealing with high-risk businesses.

In particular, this includes businesses with complicated ownership patterns without a definite structure. Following the recommended UBO verification procedures, companies can prevent financial losses, safeguard their market reputation, and comply with regulatory standards.

While legal ownership is on paper, beneficial ownership underscores tangible benefits. Disclosure of beneficial ownership is required under international agreements with other governments. International UBO Standards for beneficial ownership were first established in 2003 by the Financial Action Task Force (FATF), and in 2012, 198 governments agreed to adopt FATF guidelines.

Two years later, at the G20 Brisbane Summit, a policy declaration highlighted UBO’s openness. In layman’s language, the declaration stated, “Legal entities’ beneficial ownership information should be readily available to government agencies (such as those in charge of law enforcement and prosecution, supervision, taxation, and financial intelligence) promptly.”