In this guide, we’ll look at how to calculate a Revenue Sharing Percentage plus a Marketing Retainer Fee while charging digital online clients. Bear in mind, that as an independent marketing consultant, you have several different ways to bill clients. For example, you can charge hourly and log your hours for the client, agree to a commission structure, etc.

You can also charge a bill on a per-project basis, or use a retainer. Calculating an ongoing monthly retainer that the client must pay gives you the benefit of having your salary and fees paid all or mostly upfront. For the client, a fixed retainer may be simpler than other billing methods. Since it bundles all your services and works into one monthly figure.

The client knows how much he must pay you and can budget it into his expenses. Participants in revenue-sharing models need to be clear about how revenue is collected, measured, and distributed. The events that trigger revenue sharing, such as a ticket sale or online advertisement interaction, and the methods of calculation are not always visible to all involved.

As such, contracts often outline these methods in detail. The parties responsible for these processes are sometimes subjected to audits for accuracy assurance. Some types of revenue sharing are strictly regulated by government agencies. Specifically, in order to address perceived issues with the practice of revenue sharing for 401(k) plans.

What Is Revenue Sharing, And Why Is It Important?

Basically, revenue sharing in all forms of life is a very essential practice. For instance, when you operate a large company, you have different stakeholders. However, the profits that you/your business gets shouldn’t be limited to your company — because there are multiple stakeholders and shareholders involved.

On that note, revenue sharing is the distribution of revenue or the total amount of income generated by companies among the stakeholders or shareholders. Industries like sports/gaming use a form of revenue-sharing model. For example, gaming studios may lack the funds to pay their team upfront and decide to share the risks or rewards as soon as they generate revenue.

Another example is application development for Android and iOS ecosystems. Whereby, professional developers have to pay a certain amount to the respective store for purchases. At large, some states or even provinces can also share revenues with local governments or federal governments — there are laws in place that determine how much revenue to share.

Related Resource: Performance Management Software | #7 Key Business Benefits

When different entities come together to produce or advertise a product, a revenue-sharing model is used to ensure each entity is fairly compensated for its efforts. Today, a majority of companies use revenue management software to allocate revenues to stakeholders. With that in mind, the next question that comes in mind is: Why is a revenue sharing important?

Well, revenue sharing keeps stakeholders, shareholders, and investors happy. In fact, some companies implement it to keep their employees happy by using commissions and bonuses. Take the case of a sports league. Several sports teams use revenue sharing with the amount of revenue collected from ticket sales and merchandise.

All the teams in the National Football League (NFL) pool their revenue and this amount of money is shared among all the members.

What A Profit Revenue Sharing Percentage Entails

Revenue Sharing Percentage is a common way for businesses and governments to share in their success with key stakeholders. It can be used as a marketing strategy to help channel business their way. But it can also help them spread out the risk by ensuring that their partners are responsible for their losses, too.

Typically, revenue sharing percentage agreements have a range of 2% to 10% of revenue share — depending on the size of their business entities. But, it’s important that all the rights, responsibilities, and obligations are laid out and understood by companies and their partners to avoid any problems in the future. What about the allocated/deposited money?

Suffice it to say that; the revenue-sharing accounts are stipulated in the revenue-sharing agreement. Technically, the fiduciary must notify investors of how the revenue is spent. Doing so helps provide investors with transparency. As a rule of thumb, companies that use revenue sharing should ensure that the terms and conditions of this business model are in place.

And also, make sure that they are clearly laid out in a written contract — (This is very important so as to avoid any conflicts that may arise in the future). They should also make sure that these partnerships lay down the foundations for exclusivity. After all, companies don’t want their alliances to stray and funnel business to their competition.

What A Marketing Retainer Fee Is All About

In other words, a Marketing Retainer Fee is the overall Revenue Sharing Percentage (RSP). It means the percentage of Gross Revenue that the Issuer is obligated to pay pursuant to this Agreement until the Holders have received total payments equal to their agreed-upon Investment Multiple. For most businesses, RSP means 19% of each month’s Monthly Revenue.

In addition, the Contractor may reduce fees at any time, with the exception of the Recyclable Floor Price and Revenue Sharing Percentage, by submitting a request to Procurement Services and/or the Authorized User. For all Unit Pricing, the prices bid during the Mini-Bid shall be less than or equal to the corresponding Unit Prices awarded for the Master Contract.

Perse, with the exception of the Recyclable Floor Price and Revenue Sharing Percentage. Overall, for which the prices bid during the Mini-Bid must be equal to or greater than the corresponding Unit Prices awarded for the Master Contract. The Recyclable Floor Price and Revenue Sharing Percentage may be increased at any time by submitting a request to an agency.

Especially, when it comes to Procurement Services and/or the Authorized User. The CPI adjustment shall apply to all Master Contract and Mini-bid Contract unit pricing. Except for the Recyclable Floor Price and Revenue Sharing Percentage in that case. So, with that in mind, what is a Typical Revenue Sharing Percentage in layman’s language?

What A Typical Revenue Sharing Percentage Features

By all means, as we aforementioned, a revenue-sharing strategy can be used as an incentive to get partners and associates to help companies build their brands and business. This is done by distributing revenue every time someone recommends a new client or customer. This allows businesses to form strategic alliances and partnerships with external stakeholders.

Adopting this kind of strategy can be fairly cost-effective. Not only does it create an incentive for partners to channel more business toward a company, but it also cuts back on certain expenses. Since these are partnerships, companies don’t have to spend on wages, benefits, or other costs related to employing workers. What is a typical revenue-sharing percentage?

Well, the revenue sharing percentage, typically, ranges anywhere between 2% to 10%. This will depend on how many stakeholders are involved and the size of the company. So, which are the most common types of revenue sharing? To enumerate, revenue sharing takes many different forms.

Learn More: What Is Revenue Sharing? Importance, Benefits, and Methods

Realistically, each iteration involves a few key things. Such as sharing operating profits or losses among different financial actors. It is sometimes used as an incentive program. For instance, a small business owner may pay associates a percentage-based reward for referring new customers. It may also be used to distribute profits from a business alliance.

Or rather, when different companies jointly produce or advertise a product. Whereby, a profit-sharing system might be used to ensure that each entity is compensated for its efforts. Below are a few types of revenue sharing that are worth mentioning. So that you get a full idea of what we are talking about.

Professional Sports Profit

Several major professional sports leagues use revenue sharing with ticket proceeds and merchandising. For example, the separate organizations that run each team in the NFL jointly pool together large portions of their revenues and distribute them among all members. As of 2020, the NFL and the players’ union agreed to a revenue share split amongst all entities.

Something that would pay the team owners 53% of the revenue generated while players would receive 47%. In 2019, the NFL generated about $16 billion in revenue, meaning that slightly more than $8.5 billion was disbursed to the teams while the remaining got paid out to the players. Various kickers and stipulations can be added to revenue-sharing agreements.

For instance, if the NFL season is extended from 16 to 17 games in the coming years, the players would receive additional revenue or a kicker if advertising revenue from TV contracts increased by 60%.1. In other words, revenue sharing agreements can include percentage increases or decreases in the future depending on performance or specific pre-set metrics.

Company Revenue Sharing

Revenue sharing can also take place within a single organization. Whereby, operating profits and losses might be distributed to stakeholders and general or limited partners. What about revenue-sharing models that involve more than one business?

Of course, the inner workings of these plans normally require contractual agreements between all involved parties. Also, how are losses split between parties in a revenue-sharing program? Well, each party is responsible for paying a share of the losses in this type of business model.

Online Digital Businesses

The growth of online businesses and advertising models has led to cost-per-sale revenue sharing, in which any sales generated through an advertisement being fulfilled are shared by the company offering the service and the digital property where the ad appeared. There are also web content creators who are compensated based on the level of traffic generated.

Whether from their writing or design, a process that is sometimes referred to as revenue sharing. As an example, in our case, as per the Digital Online Marketing Standard Act, as an agency, we retain 40% while the client owns 60% of the in-stream loyalties.

At the same time, for business products, we also have a working calculation method in place. In particular, on a basis of whether we are in a solid partnership, we act as an affiliate, or rather, if we earn a sales commission.

A Strategic Revenue Sharing Percentage Calculation Plan

Let’s take the case of businesses such as Airlines. Well, the revenue sharing percentage for all signatories shall be equal to thirty-five percent (35%). The Signatory Airlines’ total Revenue Sharing Amount shall be an amount equal to the Net Remaining Revenues after Settlement, if any, multiplied by the Revenue Sharing Percentage (35%).

The practical details for each type of revenue-sharing plan are different, but the conceptual purpose is consistent: It uses profits to enable separate actors to develop efficiencies or innovate in mutually beneficial ways. The practice is now a popular tool within corporate governance to promote partnerships and increase sales or share costs.

Revenue sharing is also used in reference to the Employee Retirement Income Security Act (ERISA) budget accounts for mutual funds between 401(k) providers. ERISA establishes standards and implements rules for fiduciaries (or investment companies) to follow in an effort to prevent misusing plan assets. Standards can include the level of participation needed.

Especially, by all business employees and the funding of retirement plans. ERISA allows revenue sharing for retirement plan sponsors so that a portion of earned income from mutual funds would be held in a spending account. The funds are used to pay for the costs of managing and running the 401(k) plans.

Revenue Sharing Vs Profit Sharing

With the revenue-sharing model, businesses keep some of the revenue it receives and splits it among their stakeholders, shareholders, and investors. Some companies may even share this with third-party sellers who sell their products or services on their behalf. In this way, the regulator allows the operator to keep some portion of the revenues it receives.

Specifically, beyond a pre-specified point — from selling the product or service. The operator is required to give the rest to customers through price reductions, refunds, or increased investment in facilities or services. On one hand, most people often confuse revenue sharing with profit sharing. And for good reason, too, because they sound the same.

In simple terms, profit-sharing gives employees a certain amount of a company’s profits. This depends on business profits, current employee wages, and the amount set by the company. To enumerate, a profit-sharing plan, also known as PSP, gives employees a certain amount of money based on the company’s earnings over a predetermined period of time.

The amount of the profits comes in the form of cash or stock if the company is publicly listed. On the other side, a general revenue-sharing business model pattern is the distribution of income generated by the sale of goods or services between the stakeholders and the contributors. After expenditures, the company shares the remaining revenue with its employees.

Either way, the ultimate goal between management and shareholders is fully aligned toward generating sustainable revenue.

Learn More: How Revenue Sharing Works in Practice – By Investopedia

So, we can clearly state that revenue sharing is a business model that allows companies to share its success with stakeholders. It is a somewhat flexible concept that involves sharing operating profits or losses among associated financial actors. The primary benefit of a revenue-sharing investment is that its structure allows participants to focus on shared success.

While they both involve the distribution of money from the business with certain parties, these two models are actually quite different. Always remember, that revenue sharing distributes profit and losses equally among the key players. Still, profit-sharing, on the other hand, only distributes profits to each party — not total revenue.

Eventually, this means, that there is only a distribution if there is a profit. So, as a result, nothing is distributed if the company nets a loss during a certain period. There are some of the most common types of profit-sharing plans that are offered by companies to their employees.

Consider the following:

- Employer-to-employee retirement contribution plans

- Cash distributions as well as deferred profit-sharing plans

Sometimes, companies often use profit-sharing plans to incentivize their employees. It provides workers with some motivation to work harder. As well as ensure that the company is a success and profitable. It also promotes loyalty — an employee who gets a share of the company’s profits will be more likely to stay. Rather than jump ship and move on to work with someone else.

At all costs, the working group should determine that revenue sharing is an acceptable practice. And that all new rules implementation related to transparency under the authority of the Department of Labor (DOL) are clear. In addition, it should also determine that it should take the lead to formally define revenue sharing with regard to defined contribution plans.

What A Marketing Retainer Fee Entails In Digital Online

To understand revenue sharing and arrive at a suitable marketing retainer fee, we must first note that: Marketing is an important part of any business. It’s one way that most brands succeed in awareness terms. Having the right strategy can help set a company apart from its competition. If executed correctly, companies can use revenue sharing as a great marketing strategy.

Revenue sharing can be used as an incentive to get partners and associates to help companies build their brands and business. This is done by distributing revenue every time someone recommends a new client or customer. This allows businesses to form strategic alliances and partnerships with external stakeholders.

Ultimately, adopting this kind of strategy can be fairly cost-effective. Not only does it create an incentive for partners to channel more business toward a company, but it also cuts back on certain expenses. Since these are partnerships, companies don’t have to spend on wages, benefits, or other costs related to employing workers.

A typical revenue-sharing agreement includes:

- the list of the main business parties involved in the agreement,

- the overall obligations and responsibilities of each party involved,

- the percentage of revenue sharing with some exclusivity to the draft agreement,

- a working duration period, or otherwise, the length in which the relationship will take,

- any means of arbitration, governing laws, and jurisdictions that may apply to all parties,

- how the future agreement amendments handling will fall into action, etc.

Be that as it may, the agreement must be signed and a copy must be given to all parties involved. Forthwith, in order to calculate the said revenue sharing, you’ll need to consider a few things. First of all, you’ll need to take the amount of an individual’s contribution into account. And then, multiply it by the percentage of revenue sharing that was set out.

A Sample Method To Determine Marketing Retainer Fees

To begin with, as a marketing agency, you can choose to determine your annual salary first. Choose an amount based on a figure that you’ve earned for doing similar work as an employee of a previous employer, what other marketing consultants in your industry earn, or a combination of other factors. For example, assume you want to earn an $80,000 salary.

In that case, you can calculate your annual overhead and add it to your salary. Overhead includes all the expenses you incur to do business, such as travel expenses, office rent, equipment, stationery and supplies, insurance, and phone bills. Let’s assume your overhead for the year totals $45,000. Using a salary of $80,000, adding $45,000 equals $125,000.

Calculate a profit margin as a percentage of overhead and labor (your salary) costs. Profit margins for a consulting business may range anywhere from 15 to 25 percent, on average. Add your calculated profit margin to your salary and overhead. In this instance, assume you would like a 20 percent profit margin. Multiplying 20% (0.20) by $125,000 equals $25,000.

Adding the two figures equals $150,000. Estimate the amount of time you’ll be working for your clients. As a marketing consultant, you can probably estimate that you’ll spend about 65 to 75 percent of your time working on client projects, while the rest of your time may be devoted to administrative tasks and marketing your own business.

Learn More: 5 Reasons Why You Should Choose Revenue Sharing

A standard year in which you work eight hours a day, five days a week, and allow for a couple of weeks’ vacation consists of 2,000 hours. Multiplying 2,000 hours by 70 percent of the time you’ll be working directly for your clients equals 1,400 billable hours. Divide the annual figure you calculated (salary plus overhead and profit margin) by your billable hours.

Generally, so that you can determine the hourly rate you must charge clients. In this instance, dividing $150,000 by 1,400 equals $107 per hour. Next, compare your hourly rate to others in your industry. Adjust your rate up or down, depending on what you find and how competitive you wish to be. You can also find out the hourly rates that other marketing consultants earn.

To do so, you’ll need to contact a professional organization or an association agency — on your field basis — or rather, read the association’s publications. You can also ask other professional marketing consultants about their rates or discuss rates and fees with potential clients and customers. In other words, feel free to get in touch so that we can sort you out.

Getting Started With Revenue Management Solutions (RMS)

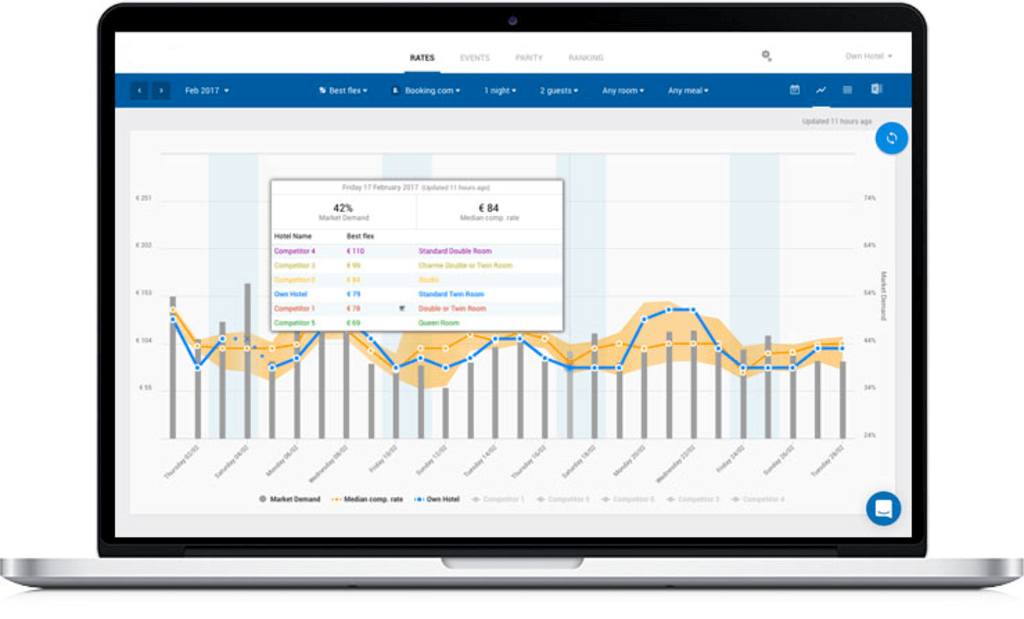

By all means, Revenue Management Software (RMS) is a toolkit that your business needs to automate the process of leveraging analytics. In the hospitality industry, it’s used to determine the right price for hotel rooms, thereby maximizing profitability and revenue. With Revenue Management Software, a hotelier is able to sell the right product to the right customer.

And on the right distribution channel for the right price. For one thing, the tool uses historical data, market triggers, and demand signals to give insights and recommendations for each room type and segment at the property. Furthermore, the information you receive is channel-specific, allowing you to price accordingly on multiple distribution channels.

Moving on, there are a few things to qualify it for inclusion in the revenue management software category on G2.

The revenue management software must:

- Help track pricing details of products and services

- Help with revenue recognition and allocation

- Manage different types of revenue

- Analyze the performance of various offers and packages

- Provide the impact of discounts on revenue

- Monitor revenue per customer

- Help provide best practices for optimizing revenue management

So, essentially, a Revenue Management System (RMS), or short RMS, is a software solution, which allows you to carry out important revenue management tasks more efficiently and effectively. As an example, it will make use of data from your own hotel business, and from the market at large, in order to help you to make more informed decisions.

The Main Revenue-Sharing Pros:

In the revenue-sharing style of funding, investors fund a company and receive a percentage of that company’s revenue. This is typically in the range of two to ten percent. The returns depend on the company’s growth. Below are some of the benefits of revenue sharing:

-

Shared growth

The structure of revenue sharing allows all parties involved to share revenue. The company and all its shareholders focus solely on generating sustainable revenue.

-

Less impact on the bottom line

Revenue sharing takes a percent of the investment’s gross revenue. This implies that even if your company has a slower rate of revenue for a month, there is less impact on your bottom line.

-

You remain in control

Once you meet the repayment cap, you don’t have to share future revenue with your investors or shareholders. You retain full ownership and control over your company.

-

Higher chance of funding

This model gives companies a higher chance of being funded since the focus is on revenue growth. The changes in potential investments are bigger.

-

Provides better direction

Revenue sharing does away with equity. Investors are simply creditors instead of owners of a business. Hence, there is a better direction, and you can focus on growth and higher profits and returns. The focus on revenue instead of acquisition makes success easier.

The Main Revenue-Sharing Cons:

While advantageous, revenue sharing does have its fair share of downsides such as shifts in focus and giving rise to errors. Below are some of the disadvantages of revenue sharing:

-

Losing sight of longer-term goals

- While the priority on revenue is key, there are chances that this will be directed towards generating it quickly. This can cause teams to lose sight of larger and longer-term goals, which is not good for business. It is not ideal for revenue generation to happen at the cost of being profitable.

-

Time spent on reporting and accounting

- There is significant time devoted to accounting and reporting the partnerships closed deals and final prices when a revenue share is involved. If there is no efficient system in place that defines how both sides gather information, this increases the possibility of errors. This causes doubt about strains in relationships that otherwise would provide many benefits.

As aforementioned, most companies use revenue management software to check if sales numbers match customer payments, distribute revenue with stakeholders, and monitor the performance of products and services. All in all, using revenue management software helps evaluate revenue data and avoid all the downsides mentioned above…

Takeaway Thoughts:

As you can see, establishing the right eCommerce business models is an important part of any business. It lays out the foundations of certain business practices, such as the products and services a company plans to sell, its target market, how it plans to advertise, the costs associated with its day-to-day operations, and how it plans to earn money or revenue.

Some companies choose to share that revenue with certain stakeholders. This is called revenue sharing. It involves the distribution of revenue or all the money that a business takes in or loses. Put simply, all stakeholders get a share of the profits and the losses when a company chooses to implement a revenue-sharing plan.

This can be through a performance-based program. In most cases, when it comes to company employees, incentive-based for corporate partners, or award-based for players in a professional sports league.

Key Summary Notes:

- Revenue sharing is a business model that allows companies to share their success with stakeholders.

- It is a somewhat flexible concept that involves sharing operating profits or losses among associated financial actors.

- Revenue sharing can exist as a profit-sharing system that ensures each entity is compensated for its efforts.

- The growth of online businesses and advertising models has led to cost-per-sale revenue sharing.

In addition, other forms of revenue sharing include those with professional sports leagues and employee-based incentives. Particularly, when it comes to revenue sharing, private businesses aren’t the only ones that use revenue-sharing models. In fact, both the U.S. and Canadian governments use taxation revenue sharing between different levels of government.

So far, what is your take on Marketing Retainer Fee and Revenue Sharing vs. Profit Sharing as we discussed herein? Well, feel free to share your additional thoughts, opinions, suggestions, or contribution questions (for FAQ Answers) in our comments section. You can also Consult Us if you’ll need more support from our Web Tech Experts Taskforce team as well.